Capital Gains Tax 202554

Capital Gains Tax 202554 - It applies to property, shares, leases, goodwill, licences, foreign. How you report and pay your capital gains tax depends whether you sold: Capital gains tax rates How to calculate them and tips on how to, There is a capital gains tax (cgt) discount of 50% for australian individuals who own an asset for 12 months or more. Guide to capital gains tax explains.

It applies to property, shares, leases, goodwill, licences, foreign. How you report and pay your capital gains tax depends whether you sold:

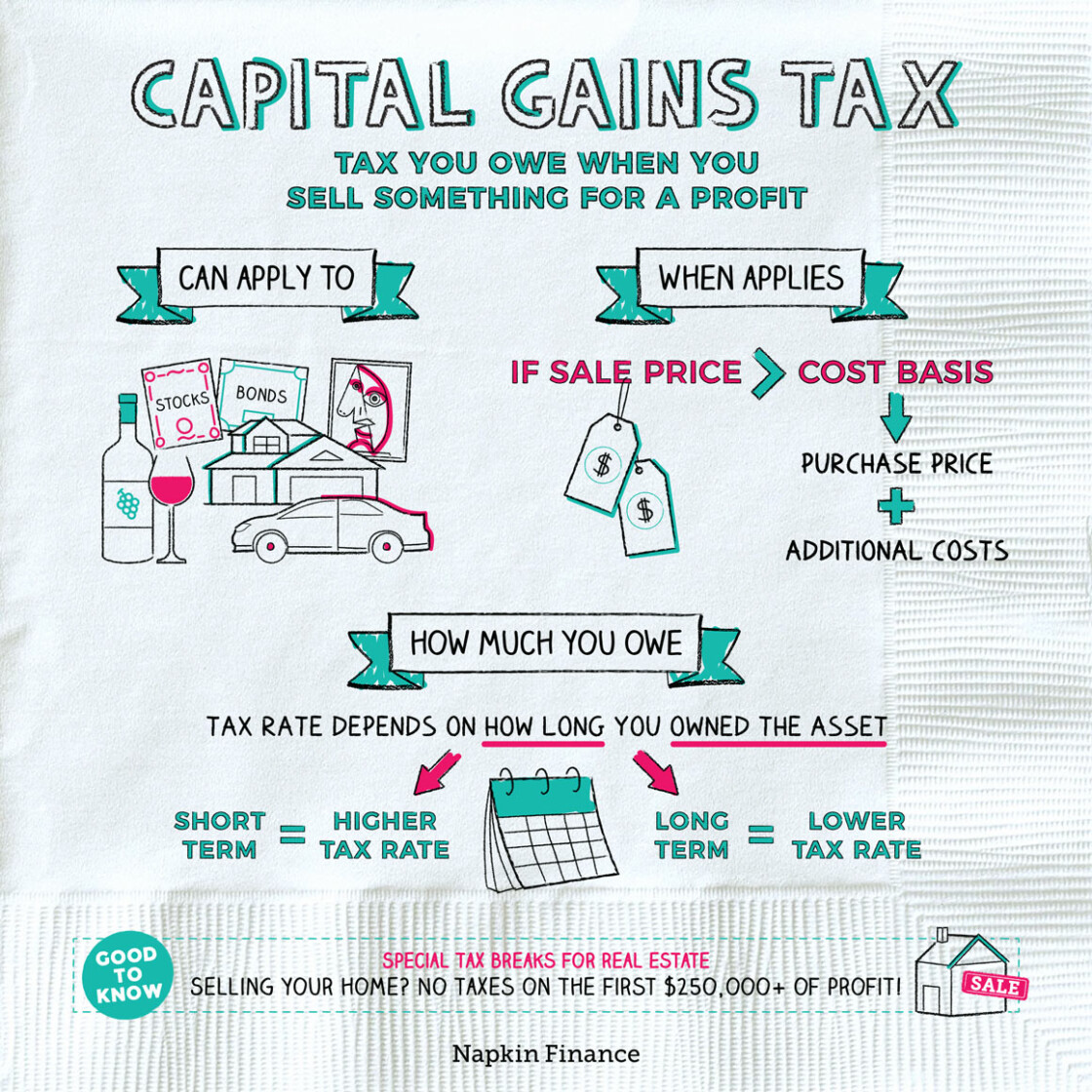

Capital Gains Tax Guide Napkin Finance, We've got all the 2025 and 2025. Capital gains are taxed at the same rate as taxable income — i.e.

Capital Gains Tax How it Works and What You Need to Know TAXGURO, A guide to capital gains tax (cgt) for individuals and entities with complex cgt obligations. Calculate your capital gains taxes and average capital gains tax rate for any year between 2021 and 2025 tax year.

Do Senior Citizens pay Capital Gains Tax When Selling Their Homes in TX, This calculator subtracts the purchase price of the. How to report your capital gains tax schedule when you lodge your return using mytax.

Land Contracts and Capital Gains What You Need to Know, Because the combined amount of £29,600 is less than £37,700 (the basic rate band for the 2025 to 2025 tax year), you pay capital gains tax at 10%. Senators say reforming capital gains tax and negative gearing will improve housing affordability, save billions.

Juno A Guide to Real Estate Capital Gains Tax, How to report your capital gains tax schedule when you lodge your return using mytax. If you earn $40,000 (32.5% tax bracket) per year and make a capital gain of $60,000, you will pay income.

The Beginner's Guide to Capital Gains Tax + Infographic Transform, What is capital gains tax? Capital gains are taxed at the same rate as taxable income — i.e.

When Do You Pay Capital Gains on a Roth IRA?, If you earn $40,000 (32.5% tax bracket) per year and make a capital gain of $60,000, you will pay income. In practice, the lifetime capital gains exemption is provided in the form of a deduction when calculating an.

The tax rates for the sale of appreciated investments and assets will stay at 0%, 15%, and 20%.

capital gains tax changes proposed Caryn Wetzel, Capital gains tax rates in 2025. The tax rates for the sale of appreciated investments and assets will stay at 0%, 15%, and 20%.

Senators say reforming capital gains tax and negative gearing will improve housing affordability, save billions.

Capital Gains Tax 202554. Mytax 2025 capital gains tax schedule. It applies to property, shares, leases, goodwill, licences, foreign.

Capital Gains Tax YouTube, The federal government has proposed an increase in the “inclusion rate” from 50% to 66.67% on capital gains above $250,000 for individuals. We've got all the 2025 and 2025.